Tulu Kapi DFS

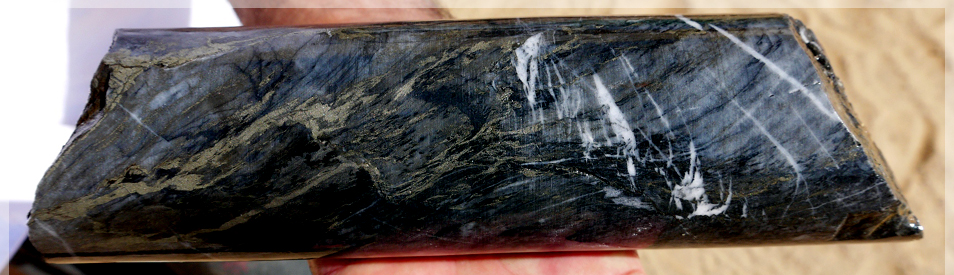

The Tulu Kapi 2015 Definitive Feasibility Study (“2015 DFS”) evaluated a conventional open-pit mining operation with a 1.2Mtpa carbon-in-leach (“CIL”) processing plant and the full study is available here.

Following the positive 2015 DFS and the engagement of Lycopodium Minerals Pty Ltd (“Lycopodium”) as the engineering, procurement and construction contractor for the construction of the processing plant, Lycopodium completed in 2016 a Front-End Engineering Design Study (“FEED Study”) for the design and construction of an integrated 1.5 Mtpa ore processing facility for Tulu Kapi.

Lycopodium then prepared the 2017 DFS Update which incorporated due diligence and refinements since the 2015 DFS and the full report is available here.

KEFI has continued to engage with the key stakeholders in Tulu Kapi to optimise project development plans. Whilst Mineral Resources, Ore Reserves and the mine plan remain essentially unchanged, the planned processing plant was expanded to a nameplate of 1.9-2.1 Mtpa, in order to increase early cash flows by reducing stockpiles. Cost estimates were updated by suppliers during Q3-2022 and further improvements have been made to the project development plans.

Tulu Kapi’s 2023 Banking Case incorporates all of the above work in relation to developing an open-pit mining operation with a CIL processing plant and an extensive overview is available here. This conservative development scenario has been analysed and approved by the Independent Technical Adviser for the Secured Lenders and provides a sound foundation for additional economic analyses.

The 2023 Banking Case does not include potential additional revenue flowing from developing an underground mine below the open pit, optimising process plant throughput or refinancing the funding package once open-pit production has settled down.

Tabulated below are the key outcomes of these studies which have all focussed on only mining the current open-pit Ore Reserves:

|

|

2015 DFS |

2017 DFS Update |

2023 Banking Case |

|

Life-of-Mine ("LOM") |

13 years |

10 years |

8 years |

|

Mining Strategy |

Owner mining |

Contract mining |

Contract mining |

|

Waste:ore ratio |

7.4:1.0 |

7.4:1.0 |

7.4:1.0 |

|

Processing rate warranted |

1.2Mtpa |

1.5-1.7Mtpa |

1.9-2.1Mtpa |

|

Total ore processed |

15.4Mt |

15.4Mt |

15.4Mt |

|

Average head grade |

2.1g/t gold |

2.1g/t gold |

2.1g/t gold |

|

Gold recoveries |

91.5% |

93.3% |

93.7% |

|

Annual steady-state gold production |

95,000 ounces |

115,000 ounces |

135,000 ounces |

|

Total LOM gold production |

961,000 ounces |

980,000 ounces |

1.2M ounces |

|

Gold price |

$1,250/oz |

1,300/oz |

1,550/oz |

|

All-in Sustaining Costs |

$724/oz |

$801/oz |

$1,040/oz |

|

All-in Costs (incl. initial capex) |

|

$937/oz |

$1,336/oz |

|

Average net operating cash flow |

$50M p.a. |

$60M p.a. |

$91M p.a. |

- AISC include all operating costs, maintenance capital and royalties.

- Royalties increase with the gold price and therefore so does AISC.

- LOM is the time to mine the planned open pit only.

- Gold production and net operating cash flow are for the first seven to eight years of gold production.

The same Mineral Resources and Ore Reserves underlie the production schedules of all three studies.

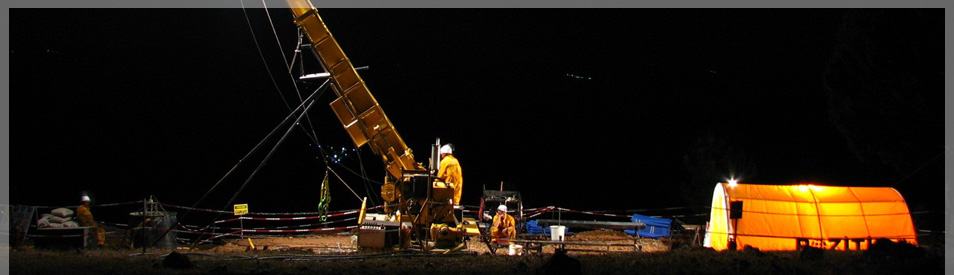

The implementation plans have been agreed on a base schedule of 24 months from full closing of project finance to first gold pour. Incentive arrangements encourage faster start-up.

KEFI also targets further increases in Tulu Kapi’s gold production with the addition of an underground mine operating concurrently with the open pit.