Tulu Kapi DFS

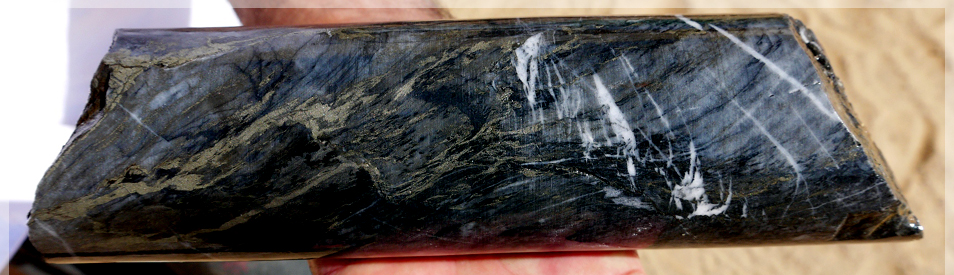

The Tulu Kapi 2015 Definitive Feasibility Study (“2015 DFS”) evaluated a conventional open-pit mining operation with a 1.2Mtpa carbon-in-leach (“CIL”) processing plant and the full study is available here.

Following the positive 2015 DFS and the engagement of Lycopodium Minerals Pty Ltd (“Lycopodium”) as the engineering, procurement and construction contractor for the construction of the processing plant, Lycopodium completed in 2016 a Front-End Engineering Design Study (“FEED Study”) for the design and construction of an integrated 1.5 Mtpa ore processing facility for Tulu Kapi.

Lycopodium then prepared the 2017 DFS Update which incorporated due diligence and refinements since the 2015 DFS and the full report is available here.

KEFI has continued to engage with the key stakeholders in Tulu Kapi to optimise project development plans. Whilst Mineral Resources, Ore Reserves and the mine plan remain essentially unchanged, the planned processing plant was expanded to a nameplate of 1.9-2.1 Mtpa, in order to increase early cash flows by reducing stockpiles.

Since 2017, the DFS has been reviewed in consultation with technical experts and refined as appropriate with detailed operational optimisation and updated contract pricing, terms and conditions. This work is summarised in the Tulu Kapi Project Overview (March 2025).

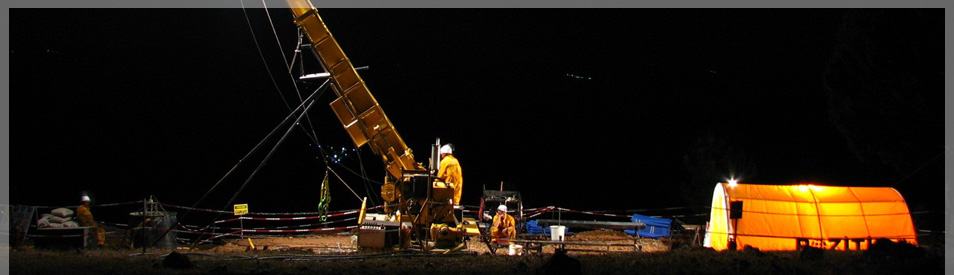

The implementation plans have been agreed on a base schedule of 24 months from full closing of project finance to first gold pour. Incentive arrangements encourage faster start-up.

KEFI also targets further increases in Tulu Kapi’s gold production with the addition of an underground mine operating concurrently with the open pit.